Farm Risk Management: How to Choose the Right Crop Insurance Policy

Crop Insurance is an excellent tool for mitigating a loss of income in years where the weather or prices won’t cooperate. However, with all of the different policies, options, and endorsements, it can be hard to know what products you’ll benefit from most.

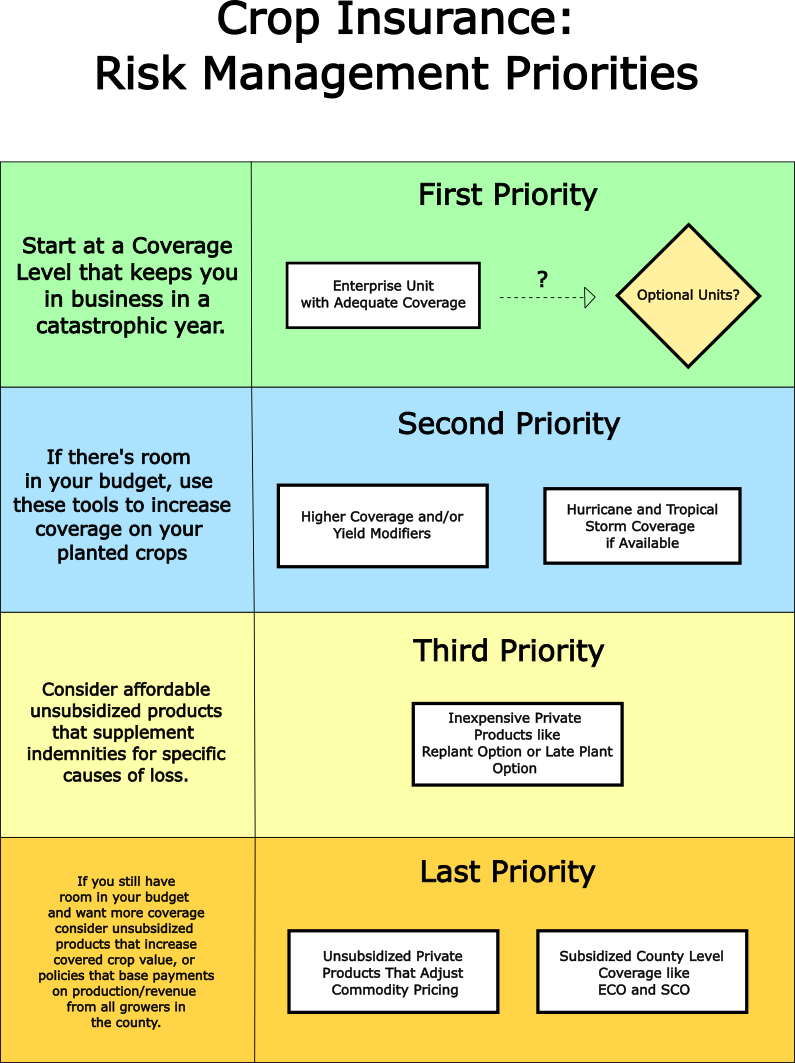

The Priorities Chart below summarizes our approach to crop insurance and the way I believe you should prioritize your farm’s risk management. I won’t be going into the nitty gritty of each program, but you’ll find links to more in depth descriptions within each section. In this article, I’ll share why, when, and how you should use each product to protect your operation.

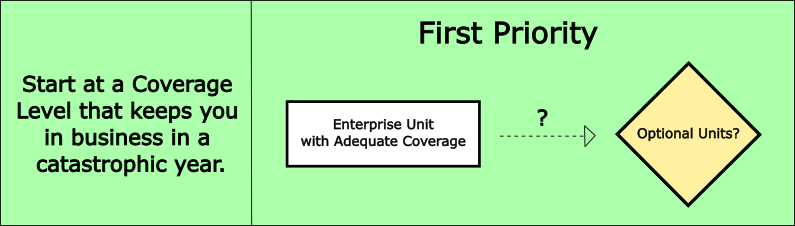

First Priority: Identify Your Needs in a Loss Year

When you think about your risk management options, always start by asking yourself: How much money do I need if it forgets to rain this year? Use that value to identify a coverage level as your starting point. This basic policy should be the core of your risk management strategy, and as long as you’ve answered this first question, you can be confident that you have the protection you need to make it through a disaster. Then, if there’s more room in your budget or you have particular perils you're concerned about, increase your coverage or add options accordingly.

For most growers, this starting point will be a 70%, 75%, or 80% Revenue Protection policy (RP) on an Enterprise Unit (EU). These types of policies are based on your yield average over multiple years and guarantee a percentage of that yield and revenue. Essentially, they provide a floor for the amount of money you are guaranteed per acre in a year that your crop underproduces.

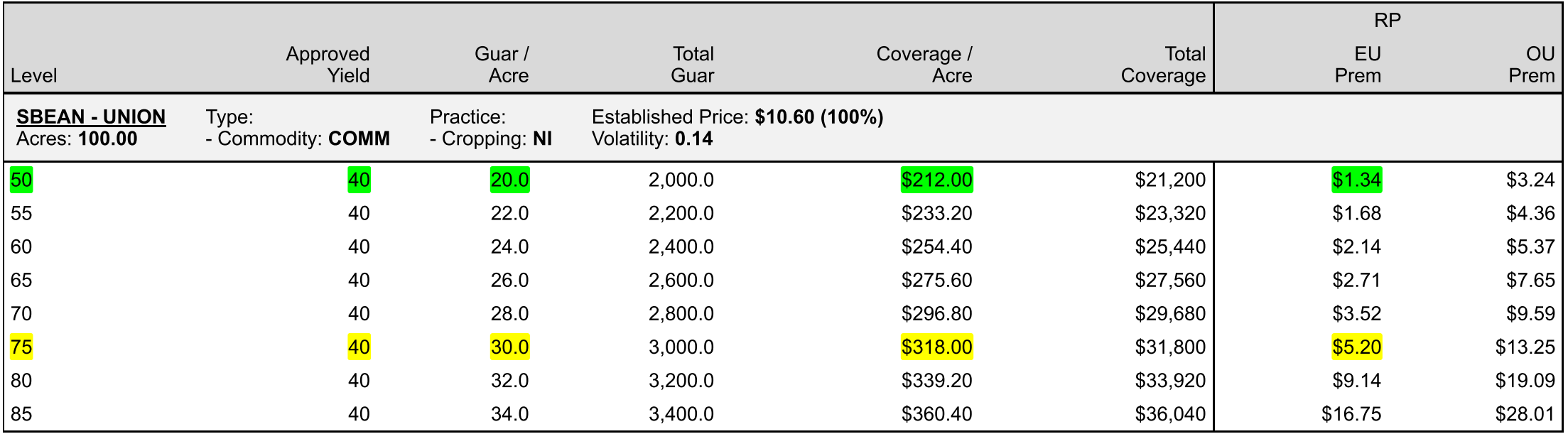

Below is a sample quote from 2025 for soybean coverage in Union County, NC. The 75% level, highlighted in yellow, covers 75% of the 40 bu/acre average, and guarantees 30 bu/acre. If the crop produces nothing, the payout would be $318/acre and would only cost $5.20 in premium.

Generally, this 75% Enterprise Unit is a great option for affordable coverage that will keep you in business. It’s probably not going to pay out in a year with slightly below average yields, but it provides enough protection to keep you going in that one in ten disaster year. However, everyone’s operation is different. If you’re diversified and think that all you need to get by is $200/ acre, then take the 50% level (highlighted in green) and cut the premium down to less than $1.50/ acre.

What about Optional Units (OU)?

Where an Enterprise Unit (EU) provides a guarantee for all of the crop that you have in one county, OU guarantees each farm individually. While you’re more likely to collect in any given year with OU, the premium is two to three times more expensive than EU.

If your farms are spread out across a large area and you consistently have significant damage on a handful of farms even in good years, the higher OU premium might be worth it. However, for growers in a concentrated area who don't have much variability in production, I recommend EU as the better option

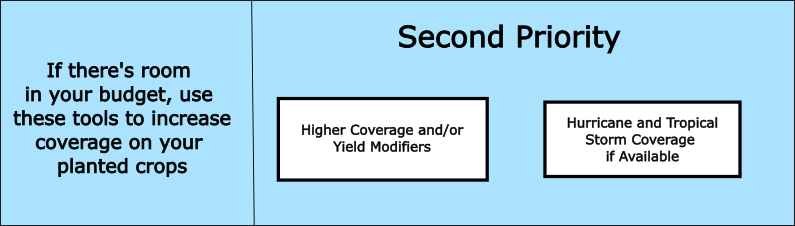

Second Priority: More Protection, Trigger Losses Sooner, Additional Affordable Endorsements

So you’ve answered your First Question, but you’d like more protection. Raising your coverage level is the next obvious step, but also ask your agent about Yield Modifying Options.

Yield Exclusion, Trend Adjustment, and Quality Adjustment are three options that can be added to your policy to increase your guarantee. These yield modifiers increase your premium if they affect your yields, but usually do so for less than the cost of going to the next highest coverage level.

At our agency, we don’t automatically add these options to policies because there are drawbacks under certain conditions and they aren’t always helpful. However, we review the effect of yield modifiers on all grower policies every year and discuss them with clients if we think there is a benefit. You may be taking advantage of yield modifiers and not know it, but it is worth checking with your agent. They can be a great tool for increasing your coverage for less than the cost of going to a more expensive coverage level.

If yield modifiers don’t get you where you want to be, look at higher coverage levels that get you closer to guaranteeing your operating cost

Hurricane and Tropical Storm Coverage

The Hurricane Protection-Wind Index and Tropical Storm endorsement (HIP-WI) have been very popular in the southeast since they were introduced several years ago. Your regular Crop Insurance Policy already covers any damage you get from hurricanes or tropical storms, but these supplemental policies pay out separately if certain conditions are met.

Along the coast, storms occur frequently enough to justify the large premium and if you are further inland, the endorsement may cost less than a dollar or two per acre. At those rates, even if an event only triggers once every 30 years, you’re getting more out of it than you pay in premium.

Consider the devastation caused by Hurricane Helene in 2024. Growers across the western parts of NC and SC benefitted from significant indemnities from HIP-WI endorsements in addition to their underlying policy for only an additional dollar or so per acre in yearly premium.

Third Priority: Unsubsidized but Affordable Supplements

Most crop insurance companies offer private products that can supplement or trigger a claim under a specific cause of loss. A lot of these can be very expensive and you’re better off maximizing your underlying coverage to the 80% or 85% level before even considering.

However, there are a handful like the the Replant Option (offers larger indemnities for replants) and the Late Plant Option (extends the date you can plant up to before coverage starts to be reduced) that can be inexpensive and worth buying if these are situations you are likely to find yourself in.

Final Priority: Expensive Unsubsidized Revenue Products and County Level Policies (SCO and ECO)

All of the policies I’ve gone over are designed to protect the crop that you planted and indemnify you when there is damage to your investment. The only exception is HIP-WI which may pay even if you did not have specific damage, but is typically worth the premium.

Unsubsidized private policies are available that can further increase your coverage, but I generally don’t recommend considering those unless you’ve increased coverage level to the 80% or 85% level and added any yield modifiers that may help. We like to say “Play with all the ‘house money’ you can with the government programs before dipping deeper into your own pocket.”

Likewise, protect your personal investment as much as you can before looking at subsidized area level policies like Supplemental Coverage Option (SCO) and the Enhanced Coverage Option (ECO) that only pay if the county averages under its expected production and revenue.

With these two supplemental policies, your production history is used to calculate your guarantee, but what you harvest does not affect whether or not ECO or SCO pays a loss. It’s true that you may have a bumper crop but still get a payment from an ECO or SCO, but the opposite is also true. If you have a bad year but the county does great, you won’t see any payment from these area level policies.

Even with recent legislation that increased the subsidies, ECO and SCO also tend to be fairly expansive and may cost as much or more than your underlying policy without guaranteeing you a payment if your crop is wiped out. Additionally, production data has to be collected and analyzed across the whole county, so any loss payments will come months after harvest and damage has taken place.

Every operation has different needs and priorities, so think of these as hard rules to live by. Rather, use this information as a point of reference to build a policy that fits your needs. Communicate with your agent and make sure you’re protecting the parts of your farm that you find most vulnerable. Priority number one is to stay in business and to keep feeding the world, and we’re here to help.

Foothills Crop Insurance is a family owned insurance agency with over 85 years of combined experience. We’re experts in tailoring policies to fit grower's operation and budget. Contact us today, and let our family take care of you like you’re one of us! 800-660-8674